What Should I Be Sending My Board?

The what + when of the board package and communications

We get this question from many founders, especially first-time CEOs. I’ve seen plenty of board packages that focus on the wrong things, implying that whoever is putting together the board package (typically the CEO/founders) is wasting some of their time. In addition, board preparation certainly comes at an opportunity cost to building the business, so there’s a balance to how you approach this aspect of the CEO role.

This piece is intended to be a tactical how-to on your board package, a precursor to “How To Better Leverage Your Board.” While the items below may depend on stage, business model, and the preferences of your board directors, consider this a basic list that should be customized and aligned with your board.

“The board deck is the canary in the coal mine. A great board deck is full of critical thinking, it’s well communicated, it’s focused on what matters most.”

-Jennifer Sundberg | Co-CEO & Founder, Board Intelligence

What should I send?

An asynchronous update that is separate from quarterly board meetings

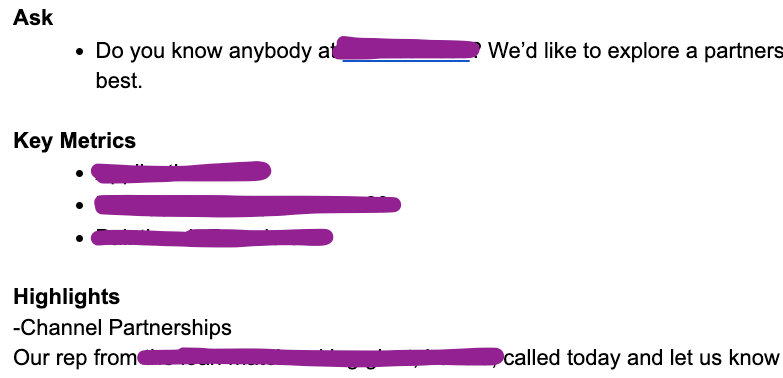

In early-stage, investors love to receive updates. Don’t overthink these; they should be brief, salient, and effective. The most common format is a monthly email. Monthly is simply an example of cadence—align on the appropriate cadence with your board member or investors.

In between the quarterly [typically in-person] formalities, an email can act as another reminder for your investors on where you as a founder would like to pull them in. Here are a few snippets of examples in my inbox that I found helpful from founders:

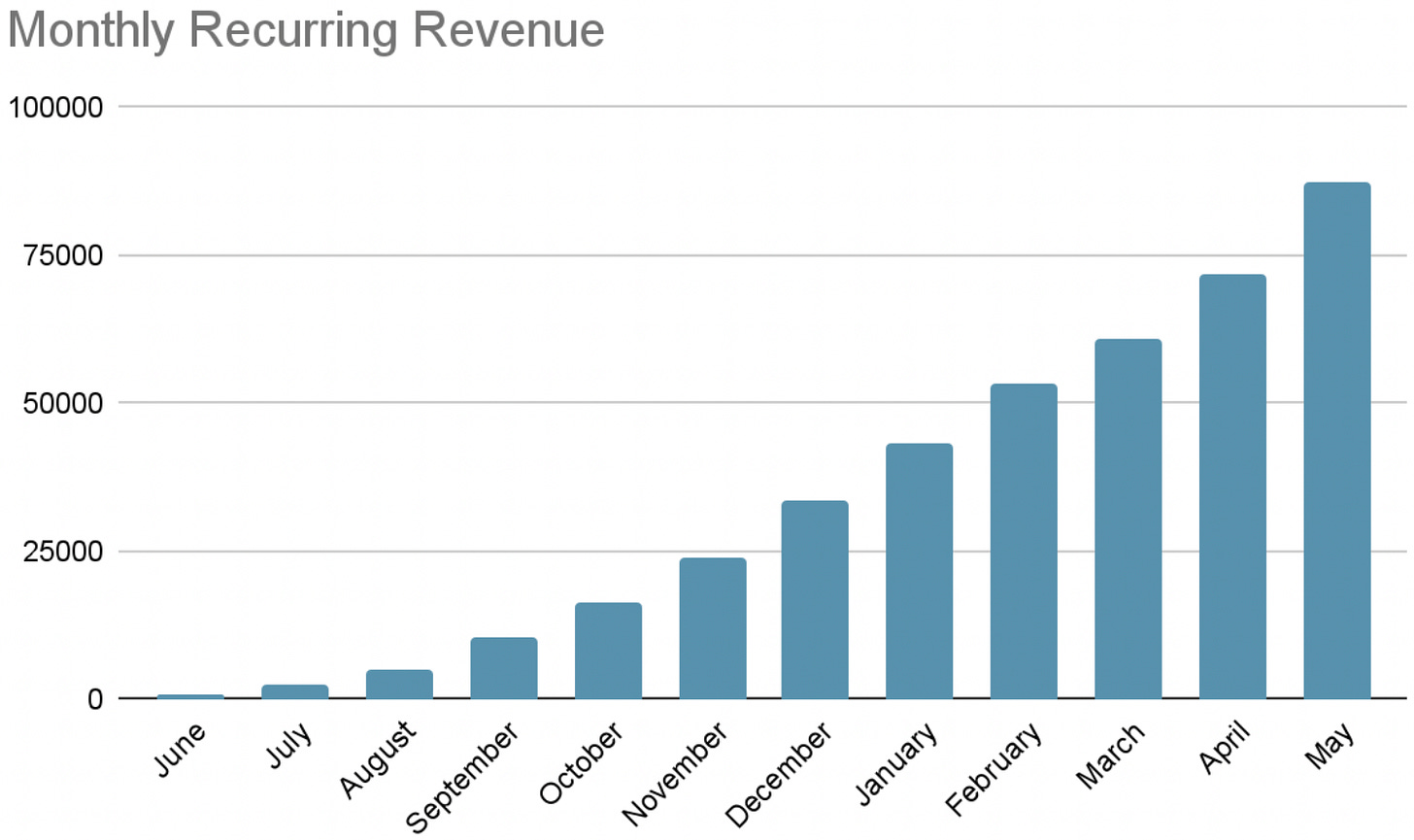

Your most pertinent metrics

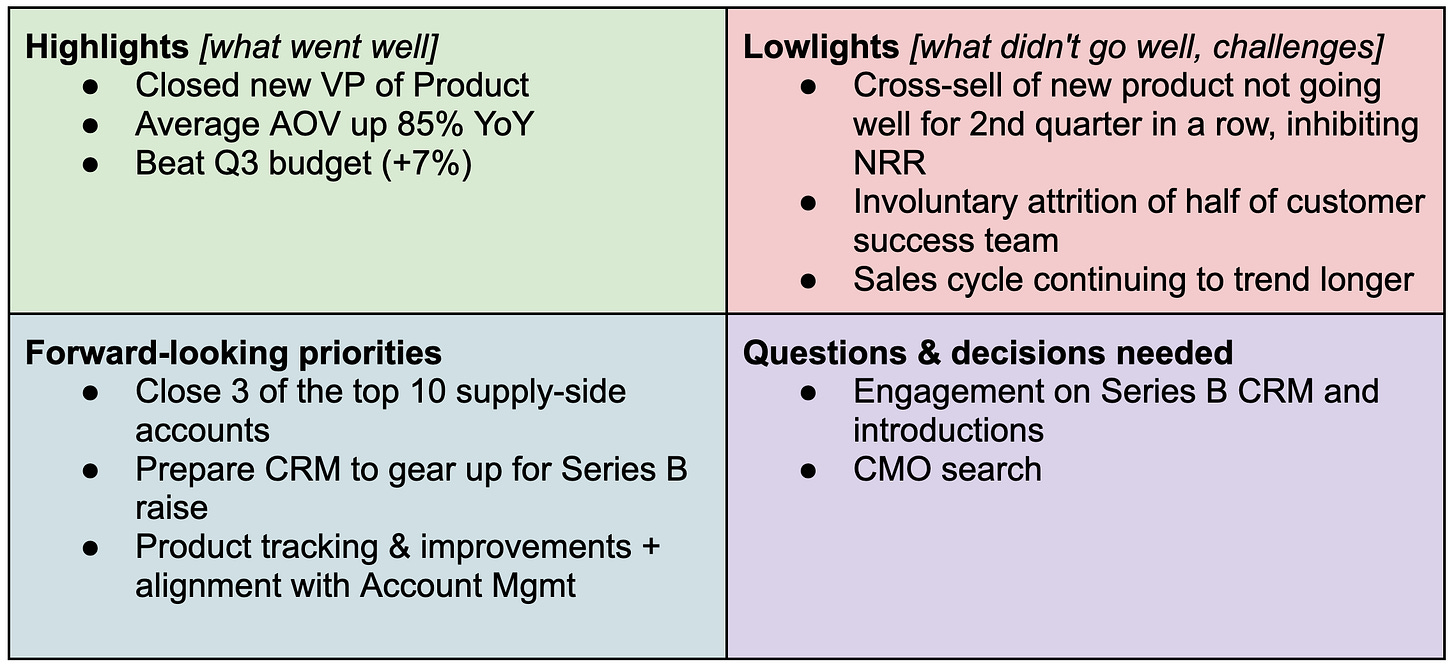

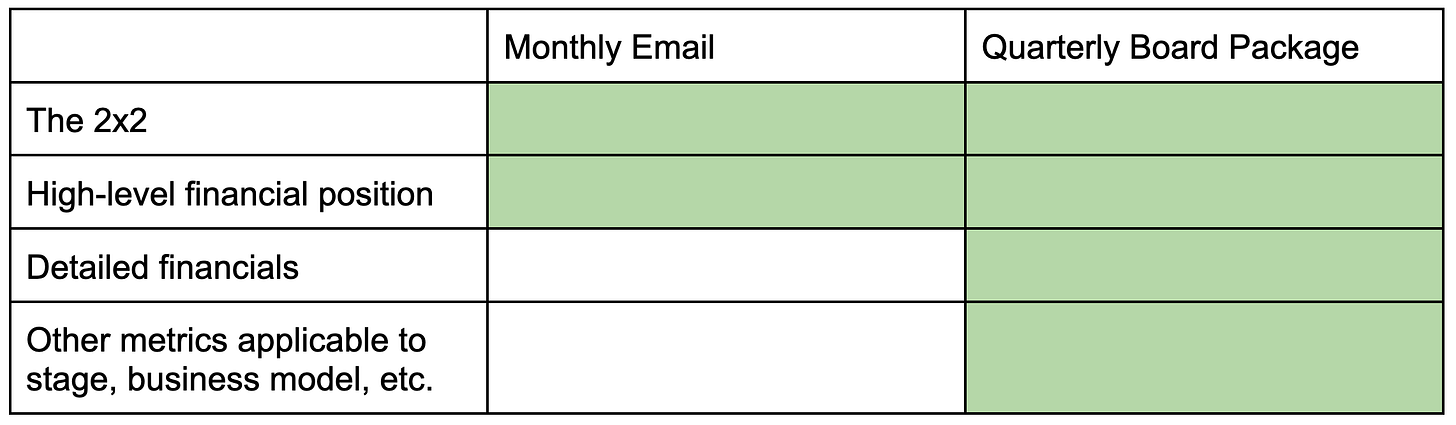

The 2x2: many of my portfolio companies use this framework for their update emails, then have a slide in the quarterly board deck. These quadrants should ideally guide the bulk of the board discussion and be where you spend most of your time.

High-level financial position: revenue, burn, cash on hand

“The worst kind of communication is irregular, or out of the blue, relays bad news like ‘I’m out of cash in a month.’”

-Alex Soffe | General Partner & CFO, Kickstart Fund

Detailed financials: P&L, balance sheet, cash forecast

Other metrics applicable to your stage, business model, or other cross-cuts

Stage examples:

As you scale, board members will increasingly expect more sophisticated data or analysis on CAC, retention, etc.

Later-stage companies may provide a portion of discussion around a theme by quarter. For instance, Q3 may review the high-level plan, BHAG, and strategic initiatives. Q4 can nicely dovetail with a budget review.

Business model examples:

Marketplace-specific company metrics typically include GMV, transactions, AOV, take rate, gross margins, etc.

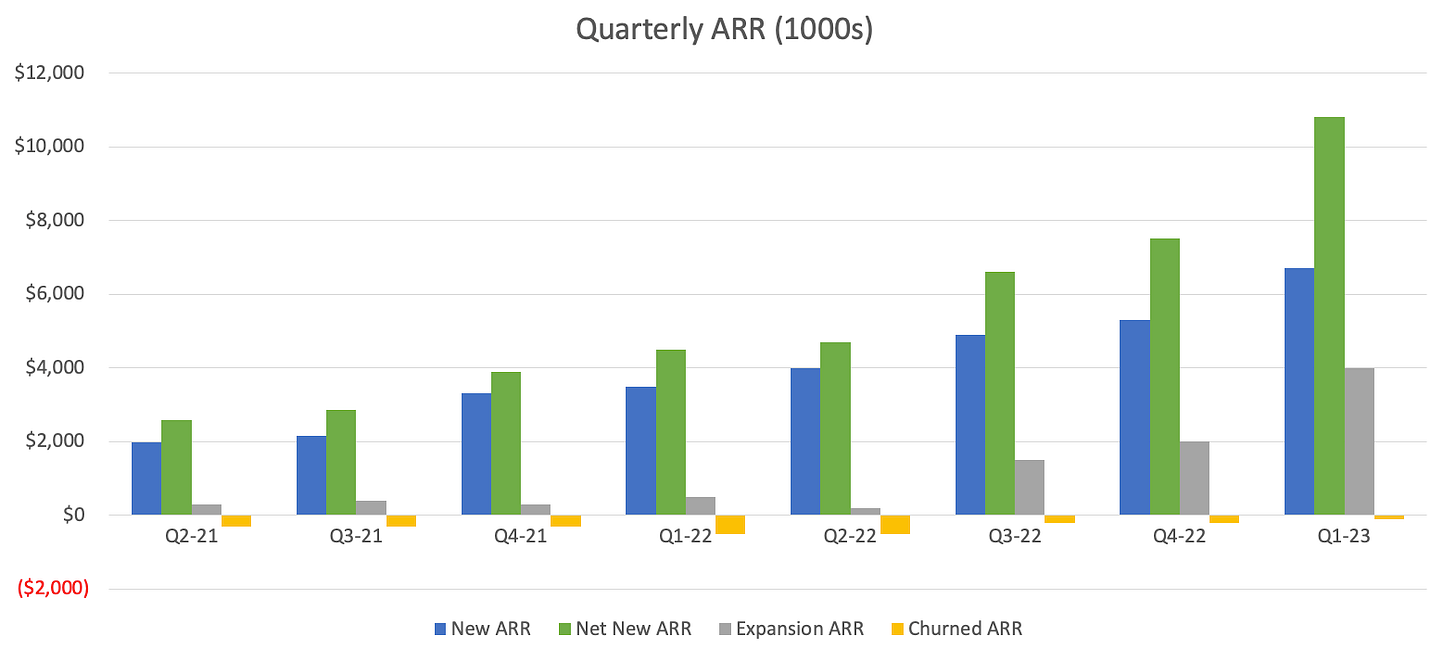

Consider leveling up by offering a longitudinal view on the metrics above (e.g., ARR by quarter). As a board director, it’s helpful to see what changed in the business since the last meeting. Without this context, it can be tricky to offer advice or recommendations.

Not all of the above “pertinent metrics” should be included in all communications. Broadly, here’s how to think about how to differentiate what to send by type of board interfacing opportunity:

Differentiate between pre-read vs. in-person materials

For the quarterly board meeting, this point becomes more applicable to companies beyond Series A. “Pre-read” means exactly what the name implies: a portion of materials should be labeled and differentiated so your board members understand that there is a section of items that should be reviewed ahead of the board meeting.

Why send a pre-read?

A majority of the board meeting’s value occurs before the meeting itself

When you lump everything together for the in-person discussion, you risk being perceived as too tactical

Allowing for Q&A ahead may clarify items that could otherwise derail your in-person board meeting

Better focus the in-person discussion on the most salient strategic items

There are certainly exceptions on deep-dives: for example, I see CEOs periodically invite an executive (e.g. VP of Marketing, CTO, etc.) to present for a portion of the discussion in the board meeting. This can be a good opportunity for the board to get visibility on certain operational initiatives, as well as for the operator/executive to interface with the board.

When should I be sending materials to my board?

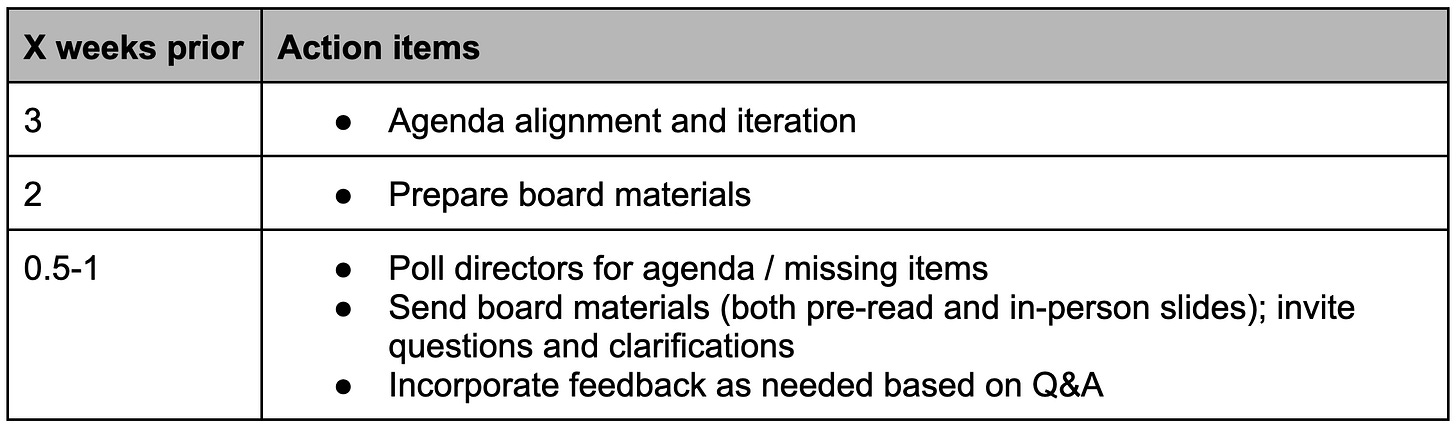

Monthly updates should be straightforward. For your quarterly board meetings: if you’re a seed to Series A company, send materials at least 24 hours in advance. If you are Series B+, consider the following timeline:

“Use board prep as an opportunity to take yourself from in-the-weeds to 30,000 feet; ask yourself, ‘what did I really accomplish?’”

-Alex Soffe | General Partner & CFO, Kickstart Fund

In the end, the last thing your board members want is for you to over-engineer board preparation or to use excessive time on preparation (versus scaling the company). Your package doesn’t need to be perfectly polished or aesthetic. Many of the items listed are expected as you scale or have a full-time CFO. Consider these best practices for an ideal state that you can customize and work through with your board.

Anything I missed? Let me know!